v1753-817

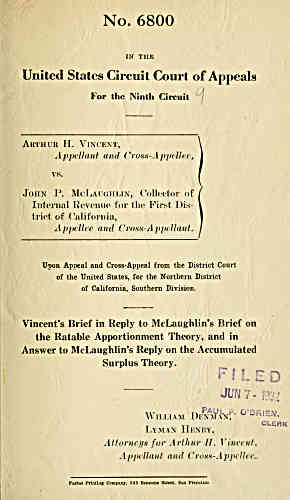

No. 6800

IN THE

United States Circuit Court of Appeals

For the Ninth Circuit

Arthur H. Vin(;ent,

Appellant and Cross- Appellee,

vs.

John P. McLaughlin, Collector' of

Internal Revenue for the First Dis-

trict of C-alifornia,

Appellee and Cross-AppeUant .

Upon Appeal and Cross-Appeal from the District Court

of the United States, for the Northern District

of California, Southern Division.

Vincent's Brief in Reply to McLaughlin's Brief on

the Ratable Apportionment Theory, and in

Answer to McLaughlin's Reply on the Accumulated

Surplus Theory.

FILED

JUN 7 - ;^:

William DenVaV;- ^'^RI^.V,

-r TT CLERK

Lymax Henry,

Affornei/s for ArfJnir H. Viuceut,

AppcUauf a)id Cross-Appdlee.

Patker Printing Company, S43 Sansome Street, San Francisco

archive.org Volume Name: govuscourtsca9briefs1753

Volume: http://archive.org/stream/govuscourtsca9briefs1753

Document Link: http://archive.org/stream/govuscourtsca9briefs1753#page/n816/mode/1up

Top Keywords (auto-generated):

1917, surplus, earnings, corporation, accumulated, decision, 31, profits, dividend, fiscal, 1916, period, mclaughlin, tax, profit

Top Key Phrases (auto-generated):

santa maria, accumulated surplus, treasury decision, section 31, maria steamship, decision 2678, ratable apportionment, apportionment theory, accounting period, income tax, pro rated, cor poration, current undistributed, 85 360ths, southern pacific

Document Status: UGLY