v2054-501

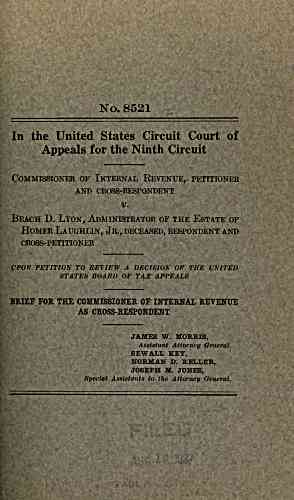

No. 8521

In the United States Circuit Court of

Appeals for the Ninth Circuit

Commissioner of Internal Revenue, petitioner

AND cross-respondent

Beach D. Lyon, Administrator of the Estate of

Homer Laughlin, Jr., deceased, respondent and

cross-petitioner

UPON PETITION TO REVIEW A DECISION OF THE UNITED

STATES BOARD OF TAX APPEALS

BRIEF FOR THE COMMISSIONER OF INTERNAL REVENUE

AS CROSS-RESPONDENT

JAMES W. MORRIS,

Assistant Attorney General.

SEW ALL KEY,

NORMAN D. KELLER,

JOSEPH M. JONES,

Special Assistants to the Attorney Oeneral.

archive.org Volume Name: govuscourtsca9briefs2054

Volume: http://archive.org/stream/govuscourtsca9briefs2054

Document Link: http://archive.org/stream/govuscourtsca9briefs2054#page/n500/mode/1up

Top Keywords (auto-generated):

lease, income, lessor, 1929, 75, lessee, bonus, taxpayer, paid, 1922, cross, tax, revenue, petition, payment

Top Key Phrases (auto-generated):

gross income, internal revenue, cross petition, cross respondent, accrual method, unconditionally payable., unconditional liability, constituted income, unearned bonus, unconditionally payable, unconditionally earned, statute involved, special assistants, seems clear, revenue petitioner

Document Status: UGLY