v2445-239

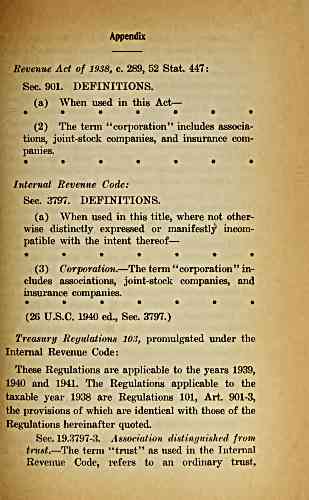

Appendix

Revenue Act of 1938, c. 289, 52 Stat. 447:

Sec. 901. DEFINITIONS.

(a) When used in this Act

(2) The term '^corporation" includes associa-

tions, joint-stock companies, and insurance com-

panies.

Internal Revenue Code:

Sec. 3797. DEFINITIONS.

(a) When used in this title, where not other-

wise distinctly expressed or manifestly incom-

patible with the intent thereof

(3) Corporation. The term ' ' corporation ' ' in-

cludes associations, joint-stock companies, and

insurance companies.

(26 U.S.C. 1940 ed., Sec. 3797.)

Treasury Regulations 103, promulgated under the

Internal Revenue Code:

These Regulations are applicable to the years 1939,

1940 and 1941. The Regulations applicable to the

taxable year 1938 are Regulations 101, Art. 901-3,

the provisions of which are identical with those of the

Regulations hereinafter quoted.

Sec. 19.3797-3. Association distingaished from

trust. The term "trust" as used in the Internal

Revenue Code, refers to an ordinary trust.

archive.org Volume Name: govuscourtsca9briefs2445

Volume: http://archive.org/stream/govuscourtsca9briefs2445

Document Link: http://archive.org/stream/govuscourtsca9briefs2445#page/n238/mode/1up

Top Keywords (auto-generated):

trust, commissioner, property, trustee, business, corporation, instant, 2d, taxable, provided, association, beneficiaries, supra, government, trustees

Top Key Phrases (auto-generated):

instant trust, association taxable, internal revenue, revenue code, beneficial interests, commissioner supra, selling agent, capital stock, section 166, national bank, liquidation trust, salient features, civil code, trust provided, transferable certificates

Document Status: UGLY