v2015-751

Tft--

, v* 1 C: "RcrTO^'

irmrain

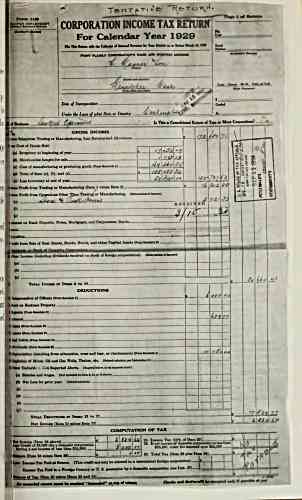

CORPORATION INCOME TAX RETURN

For Calendar Year 1929

ninihtafM.iibbxIIMll

.I.IUU..LIIMIII

ptJUM-T COf0ATlQr

-fcs*

lt*x

"'

U-jL*/-

Datt 4 lnmtfmction

VtUm&,Lm4k4SUmCma+1

^filAimA ~.:' v

Totl DiDocnom im Inn 12 to 52

Nrr Iwcomi (Item 11 mlniu Item 23)

COMPUTATION OF TAX

(Item 24 ebore) _

I of 13,000 ((or * domeetic corporation

, Mt income of Ism then 26,30) j.

tin

go a.

I (Item 25 mlnue Item 20).

UL M. Ibooom Tu (12% of Item I

" net Income of domentie corporation

25,36, enter the aowunt over $3S,0OU

(1M of Ite.

- If net Incomeof domeetic

325,380, en

.?. 10. ToUl Tax (Itm 28 plue Item 29)

:Ieome Tex Peld at Source. (Thi. credit can only be allowed to a uonreeident foreign corporation)

Income Tex Paid to a Foieifn Country or U. 8. uu a H a lnn b 7 e domeetic corporation (eee Int. 27)

I of Tex (Item 30 mtnui Iteme 31 end 32)

'kterefl

archive.org Volume Name: govuscourtsca9briefs2015

Volume: http://archive.org/stream/govuscourtsca9briefs2015

Document Link: http://archive.org/stream/govuscourtsca9briefs2015#page/n750/mode/1up

Top Keywords (auto-generated):

03, cm, os, fa, ft, cd, tax, wagner, revenue, internal, corporation, business, ph, income, eh

Top Key Phrases (auto-generated):

internal revenue, son inc., wagner son, fa fa, cm cm, 03 03, os os, os cm, net income, december 31, profit loss, income tax, cm os, preceding taxable, mill returns

Document Status: UGLY