v2048-1022

46

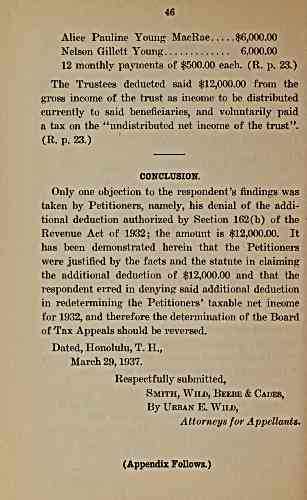

Alice Pauline Young MacRae $6,000.00

Nelson Gillett Young 6,000.00

12 monthly payments of $500.00 each. (R. p. 23.)

The Trustees deducted said $12,000.00 from the

gross income of the trust as income to be distributed

currently to said beneficiaries, and voluntarily paid

a tax on the ^^undistributed net income of the trust".

(R. p. 23.)

CONCLUSION.

Only one objection to the respondent's findings was

taken by Petitioners, namely, his denial of the addi-

tional deduction authorized by Section 162(b) of the

Revenue Act of 1932; the amount is $12,000.00. It

has been demonstrated herein that the Petitioners

were justified by the facts and the statute in claiming

the additional deduction of $12,000.00 and that the

respondent erred in denying said additional deduction

in redetermining the Petitioners' taxable net income

for 1932, and therefore the determination of the Board

of Tax Appeals should be reversed.

Dated, Honolulu, T. H.,

March 29, 1937.

Respectfully submitted.

Smith, Wild, Beebe & Cades,

By Urban E. Wild,

Attorneys for Appellants.

(Appendix Follows.)

archive.org Volume Name: govuscourtsca9briefs2048

Volume: http://archive.org/stream/govuscourtsca9briefs2048

Document Link: http://archive.org/stream/govuscourtsca9briefs2048#page/n1021/mode/1up

Top Keywords (auto-generated):

income, net, gross, deduction, trust, tax, section, allowed, taxable, revenue, property, paid, included, distributed, 1932

Top Key Phrases (auto-generated):

net income, gross income, levied collected, income derived, additional deduction, 47 stat., 209 47, young macrae, wild beebe, voluntarily paid, vocations trades, undistributed net, trustees deducted, trust ., trades businesses

Document Status: UGLY