v2356-5

P M r n

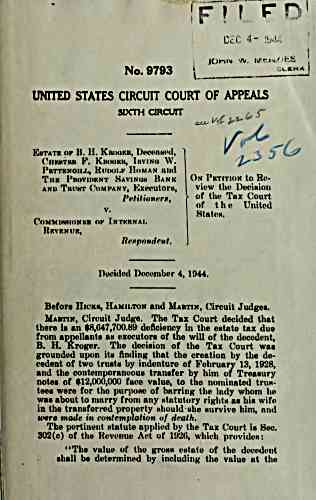

No. 9793

L

UNITED STATES CIRCUIT COURT OF APPEALS

SIXTH ciRcurr

Ehtatr ok B. II. KwKjRR, DoooaHi'd,

(^IIKMTKH F, KlUNIKK, lnVINt VV.

Pkttknoiij., I{imk)I.f IImman and

TlIK PROVIDKNT SaVIN(JH BaNK

AND TrI'MT CoMI'ANY, KxoCUtOIH,

PrlHinnfra,

COMMIHHIONKR OK InTKRNAL

Hkvrnuk,

tOtM

^v^^

(^ r

^3 J

&

On Pktition to Ro-

viuw the DociHion

of tlo Tax Court

of t h United

HtntoH.

Decided December 4, 1944,

Before Hiokr, HAMiiiTON and Martin, Circuit Judges.

Mabtin, Circuit JudKe. The Tax Court decided that

there % an $8,647,700.89 deflciencv in the ORtato tax due

from appellantii rm executom of the will of the decedent,

- KroKor. The decision of the Tax Court was

grounded upon it8 flnding that the creation by the de-

cedent of two truRtH by indenture of February 13, 1928,

and the conteinporaneouR transfer bv him of Treasury

notes of $12,000,000 face value, to the nominated truH-

tees were for the pur))()Ho of barring t)ie lady whom lie

was about to marry from any Htatutory ri^;htH as hiR wife

in the tranHferred property Hhould Hhe Hurvive him, and

were made in contemplation of death.

The pertinent Htatute applied by the Tax Court is Sec.

302(c) of the Kevenuo Act of 192(), which providcH:

"The value of the kcohh CHtate of the decedent

shall be determined by including the value at the

archive.org Volume Name: govuscourtsca9briefs2356

Volume: http://archive.org/stream/govuscourtsca9briefs2356

Document Link: http://archive.org/stream/govuscourtsca9briefs2356#page/n4/mode/1up

Top Keywords (auto-generated):

tho, tax, th, wan, death, ih, wife, wah, iiih, bin, truht, hy, tlu, ho, tlio

Top Key Phrases (auto-generated):

ri hth, wan haid, tho tax, th hulk, million dollarh, kroner family, iiih children, decedent wan, corpuh wan, bin wife, bin death, youtli anibitiouh, yoiiii livp, xovemher elections, xneviioo rfd

Document Status: UGLY