v2804-415

394

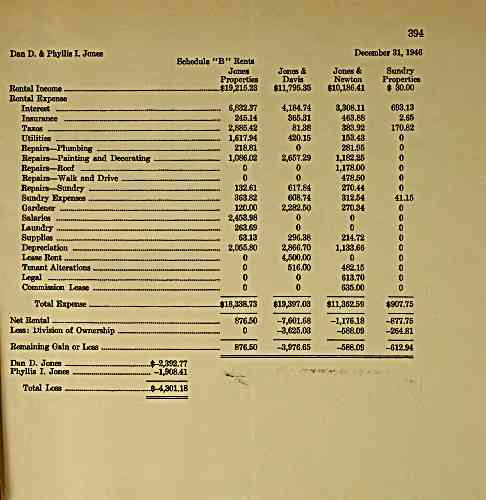

Dan D. & Phyllis I. Jones

Schedule "B" Bents

Jones

Properties

Rental Income $19,215.23

Rental Expense

Interest 6,832.37

Insurance 245.14

Taxes 2,885.42

Utilities 1,617.94

Repairs Plumbing 218.81

Repairs Painting and Decorating 1,086.02

Repairs Roof

Repairs ^Walk and Drive

Repairs Sundry 132.61

Sundry Expenses 363.82

Gardener 120.00

Salaries 2,453.98

Laundry 263,69

Supplies 63.13

Depreciation 2,055.80

Lease Rent

Tenant Alterations

Legal

Commission Lease

Total Expense $18,338.73

Net Rental 876.50

Less: Division of Ownership

Remaining Gain or Loss 876.50

Dan D. Jones $-2,392.77

Phyllis I. Jones -1,908.41 ,^.^

Total Loss $-4,301.18

December 31, 1946

Jones &

Davis

$11,795.35

Jones &

Newton

$10,186.41

Sundry

Properties

$ 30.00

4,184.74

365.31

3,308.11

463.88

693.13

2.65

81.38

383.92

170.82

420.15

153.43

281.95

2,657.29

1,182.25

1,178.00

478.50

617.84

270.44

608.74

312.54

41.15

2,282.50

270.34

296.38

214.72

2,866.70

4,500.00

516.00

1,133.66

482.15

613.70

635.00

$19,397.03

$11,362.59

-1,176.18

-588.09

$907.75

-7,601.68

-3,625.03

-877.75

-264.81

-3,976.65

-588.09

-612.94

archive.org Volume Name: govuscourtsca9briefs2804

Volume: http://archive.org/stream/govuscourtsca9briefs2804

Document Link: http://archive.org/stream/govuscourtsca9briefs2804#page/n414/mode/1up

Top Keywords (auto-generated):

jones, tax, enter, income, dan, 03, 1945, phyllis, 1944, schedule, office, item, revenue, lo, internal

Top Key Phrases (auto-generated):

internal revenue, los angeles, income tax, tax computation, 3968 wilshire, unimproved unimproved, story building, normal tax, net income, gross income, form 1040, adjusted gross, 6th calif., wilshire boulevard, treasury dept.

Document Status: UGLY