v2804-433

(Testimony of Dan D. Jones.)

410

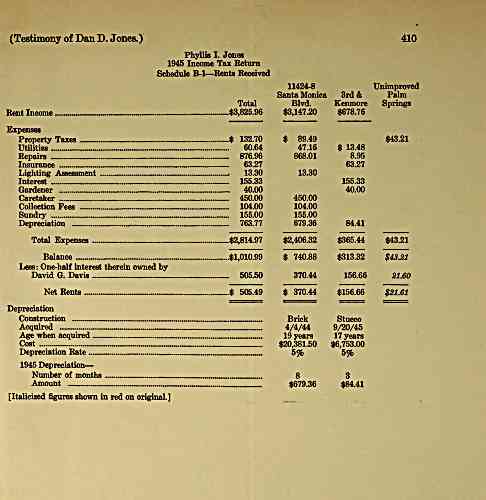

Phyllis I. Jones

1945 Income Tax Eetum

Schedule B-1 ^Rents Received

11424-8 Unimproved

Santa Monica 3rd & Palm

Total Blvd. Kenmore Springs

Rent Income $3,825.96 $3,147.20 $678.76

Expenses

Property Taxes $ 132.70 $ 89.49 $43.21

Utilities 60.64 47.16 $ 13.48

Repairs 876.96 868.01 8.95

Insurance 63.27 63.27

Lighting Assessment 13.30 13.30

Interest 155.33 155.33

Gardener 40.00 40.00

Caretaker 450.00 450.00

Collection Pees 104.00 104.00

Sundry 155.00 155.00

Depreciation 763.77 679.36 84.41

Total Expenses $2,814.97 $2,406.32 $365.44 $43.21

Balance $1,010.99 $ 740.88 $313.32 $43.21

Less : One-half interest therein owned by

David G. Davis 505.50 370.44 156.66 21.60

Net Rents $ 505.49 $ 370.44 $156.66 $21.61

Depreciation

Construction Brick Stucco

Acquired 4/4/44 9/20/45

Age when acquired 19 years 17 years

Cost $20,381.50 $6,753.00

Depreciation Rate , 5% 5%

1945 Depreciation

Number of months 8 3

Amount $679.36 $84.41

Italicized figures shown in red on original.

archive.org Volume Name: govuscourtsca9briefs2804

Volume: http://archive.org/stream/govuscourtsca9briefs2804

Document Link: http://archive.org/stream/govuscourtsca9briefs2804#page/n432/mode/1up

Top Keywords (auto-generated):

jones, property, dan, davis, net, internal, revenue, business, income, tax, money, gain, 45, 44, expenses

Top Key Phrases (auto-generated):

internal revenue, term capital, sales price, net sales, jones 1945, income tax, capital gains, 1945 income, net gain, los angeles, form 1040, unimproved unimproved, short term, rent income, property taxes

Document Status: UGLY